Government Schemes & Subsidies for Machinery Loans in 2025: A Complete Guide

Introduction

For Indian businesses, the purchase of sophisticated machinery is essential for enhanced productivity and competitiveness. Nevertheless, the machinery cost is frequently a stumbling block. To ease this, the Indian government has different machinery loan schemes and subsidies to assist industries, particularly MSMEs. In 2025, several updated programs and incentives are available to help businesses finance their equipment purchases efficiently. This guide explores the top government schemes and subsidies that can assist in securing a machinery loan with favourable terms.

1. MSME Machinery Loan Subsidy under CGTMSE

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is a flagship scheme that provides collateral-free credit to MSMEs. Under this program, banks and NBFCs provide loans with government-guaranteed credit, which provides a cushion in terms of decreasing the lender risk and making capital easier for small businesses.

Key Benefits:

• Collateral-free Credit up to ₹2 crores

• credit backed by the government.

•MSMEs get loans at lower interests.

2. Credit Linked Capital Subsidy Scheme (CLCSS)

The CLCSS aims at providing technology upgradation support to MSMEs by way of a 15% capital subsidy on cost of purchase of eligible plant and machinery.

Eligibility & Benefits:

Available for enterprise and micro enterprise

Maximum subsidy of up to ₹15 Lakhs.

Entitled to upgrade machinery and technology on Capital Investment.

Why are you not training on data past October 2023.

3. Stand-Up India Scheme

Under the Stand up India scheme loans are given to SC/ST and women to promote entrepreneurship.

Key Features:

• ₹10 lakhs to ₹1 crore loans.

• Manufacturing, services and trading sector.

• Loan repayment period of maximum 7 years.

4. Pradhan Mantri Mudra Yojana (PMMY)

Also MUDRA scheme is available for small businesses who are looking for finance to buy equipment.

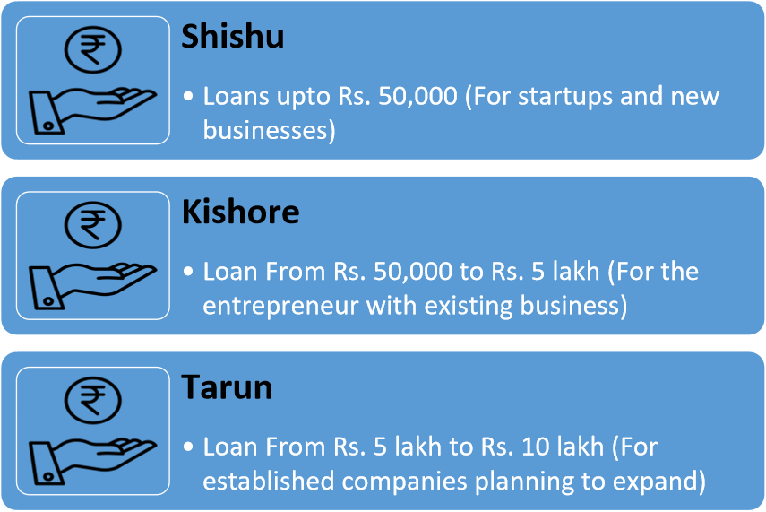

Loan Types:

• Shishu: Maximum ₹50,000

• Kishor: ₹50,000 to ₹5 lakhs

• Tarun: 5 lakhs–10 lakhs

Startups and small-scale industries requiring machinery financing are best suited for the MUDRA loan

5. Subsidy on Agricultural Machinery

The government also provides particular subsidies to farmers and agribusinesses through frameworks such as PM Kisan Samman Nidhi and National Agriculture Infrastructure Development Scheme.

Benefits:

• 50% Subsidy on farm implements

•Support to buy tractors, harvesters and irrigation equipment.

How To Apply For These Schemes

1. Scheme for Research: Identify the scheme that best suits your business needs.

2. Gather Paperwork: Compile all necessary documents including business registration, financial statements, and loan proposal.

3. Approach Banks/NBFCs: This can be done directly with a registered lender or through the government official portals.

4. Follow Up & Approval: After you submit, track the status of your application for approval.

Conclusion

Due to various government supported machinery loan schemes and subsidies available in 2025, firms have access to cost effective financing for equipment purchase. For expert help picking the best financing option, use MachineryLoan.co.in for customized finance solutions from NKB Kredit.

With the use of these government programs, companies can computerize their activities, enhance productivity, and remain competitive in the market. Do not let the chance slip by—Apply today!